Porting a mortgage takes place when you are looking to move home at the time of your fixed-rate deal. It’s actually possible as a homeowner to transfer your mortgage product and you will potentially have the option to port your mortgage if necessary.

Instead of paying the early repayment charge (ERC), the lender might give you the option to pick up the remaining amount on your current mortgage and move into the property. This option is not available to all applicants moving home as it depends on where you’re looking to move and if the lender will let you proceed with porting the mortgage.

Taking out a Second Charge mortgage can be an option if the property is valued more than what you will be paying back. If you are wanting more information about this, check out our MoneymanTV YouTube channel with our video: What is a Second Charge Mortgage?

You may find that not all mortgages are portable, especially if you are with a specialist lender as the option to port may not available to you. To find out if you can port your mortgage or not, contact your lender who can confirm this for you.

Despite porting be an option for some customers, many decide not to. The reason for this might be that your lender will not lend you extra money so you can move. If you are provided with additional funds, this will be at a separate rate from the one on your current deal. You might turn down the new deal you have been offered and decide to take the early repayment charge and go to a different lender.

When you port your mortgage, a sub-account on your mortgage is created. The additional funds will go onto a different deal to the one you have on your current mortgage. Regardless of you having one mortgage and one direct debit, two different rates of interest will apply to each.

The annoyance that can come with having sub-accounts is that down the line you may the different products will overlap. Aligning the accounts could mean that one of the sub-accounts will have to go onto the lenders’ standard variable rate for a certain period of time.

Here at Leedsmoneyman, we can offer mortgage advice when it comes to porting mortgages. Therefore, if you are moving house in Leeds and dealing with a buy to let mortgage or you are in need of support with a self employed mortgage, booking a free appointment with one of our dedicated mortgage advisors can help explore your options.

University: a place to enjoy freedom, independence and time away from the parents! However, as you know, university life comes with costs and lots of different fees. With constant bills, it can sometimes be hard to see what you’re actually paying for, particularly with student accommodation.

When it comes to student accommodation, you may feel like you’re getting your money’s worth yet sometimes you may feel the complete opposite. You’re in luck if you manage to get a landlord that looks after you and your property and takes care of damages and repairs quickly. On the contrary, you could get a landlord that isn’t responsive at all and leaves you with broken appliances for weeks on end.

Unfortunately, more often than not, students will end up getting a landlord that doesn’t give much back to them and treats them poorly. In this situation, it can make you question, is it really worth spending all of this money to get nothing back? If you’re asking yourself this question, why not consider becoming your own landlord?

When you are your own landlord, you’ll avoid all the hassle and be able to sort things out yourself. You can become your own landlord by taking out a student mortgage. Although it can be expensive in the short term, it can save you money as soon as you get the keys and start living in the property!

A student mortgage will not only allow you to save money on your accommodation but will also give you an early chance to get yourself onto the property ladder. Usually, these mortgages are more popular amongst students who are planning to carry on their education to a masters/PhD level.

Even if living within the property is temporary, you can always sell it in the future and make money back on it. Alternatively, you could turn it into a buy to let in Leeds to rent out to other students.

When your university journey comes to an end, you will have built up a large amount of equity within the property. This equity, when released, can be turned into a lump sum of cash. You can use this cash on whatever you want, whether it’s for another deposit, a wedding, a car, etc. Since it’s your money and your equity, you can spend it how you want.

There are many different things that you could do with your property in the future!

Sometimes, it can be hard to obtain a student mortgage because you’ll need funds in place to afford one, and for a student, this can be difficult.

As a mortgage broker in Leeds, when a student enquires about a mortgage, we have to ask them some questions to learn about their financial situation and see whether they’ll be able to qualify for one or not. Firstly, we will need to find out whether you have a deposit at the ready. Your deposit can be a gifted deposit, from a Lifetime ISA or even as simple as funds from a savings account.

Secondly, we need to make sure that you can actually afford a mortgage. One of our mortgage advisors in Leeds will measure this by working out your mortgage affordability. You will certainly need a form of income to get a mortgage as a student. Depending on your lender, you may be able to get a mortgage with a part-time job, however, most lenders will only accept a full-time job.

Showing reliability is key. You need to show the lender that you’re a reliable applicant that will be able to afford a mortgage. Here are a few examples of how you can increase your reliability:

Increasing initial deposit – By putting down a higher deposit, the overall amount that you’d need to borrow for a mortgage would decrease. This would also mean that your mortgage payments would decrease.

Utilising government schemes – Government-led schemes are a great way to increase your reliability for a mortgage. The schemes are under a program called “Own Your Home”, they were introduced to help first time buyers get onto the property ladder.

Through these schemes, you may be able to access a larger deposit. Some of the schemes include the Lifetime ISA and Shared Ownership. There are many more if you visit https://www.ownyourhome.gov.uk/all-schemes/.

Have an AIP ready – A mortgage agreement in principle (AIP) can benefit your student mortgage application. An AIP proves that a lender is willing to lend to you based on you providing evidential documents to support your income, mortgage affordability, etc.

This is just a few examples, there are more ways to show your reliability as a student. Get in touch with our mortgage advisors in Leeds today to find out even more ways to improve your reliability.

Likewise to other mortgage options, you will have to meet certain requirements before securing your student mortgage:

With these points in mind, we suggest that you have a think about what you are going to do with the extra rooms. It makes sense to rent them out to help support your mortgage payments each month.

Lenders won’t take any risks when it comes to offering a mortgage student. They will take careful precautions with all student applicants.

When signing off the papers for your mortgage, you’ll be asked to give a name for a guarantor. This is someone who will cover your payments if you cannot meet them at any time. There are some limitations to who your guarantor can and can’t be:

You’ll find that every lender will always have some sort of backup.

For expert help with achieving your mortgage dreams as a student and first time buyer mortgage advice in Leeds, contact our brilliant team today. We will help you see whether you qualify for a student mortgage and perform a free affordability check on you and your file.

There are many reasons why existing homeowners will want to look into taking out a second or even a third mortgage. Some examples of these include using an additional mortgage to expand your property portfolio or to help one of your family members get onto the property ladder themselves.

There may be more difficult to obtain a second mortgage, compared to when you took out your first one because you will now have two lots of mortgage payments to factor in. If you cannot afford the costs of both, you will likely not be accepted for a second mortgage.

As a Mortgage Broker in Leeds, we’ve seen people apply for a second mortgage for lots of reasons:

If you are several years into your mortgage term, chances are you have built up a substantial portion of equity within your property. Instead of remortgaging, some may look to release some of that equity for a smaller mortgage.

This type of mortgage process is known as a further advance. A further advance gives a homeowner the option to borrow more from their current mortgage lender, as a means of funding potential home improvements or the deposit for another property purchase.

A remortgage to release equity will allow you to switch to a better product with a new mortgage lender, releasing a portion of your equity.

A further advance is remortgaging with the same mortgage lender, who will have their own interest rates that will stand separately from your current mortgage balance. Whilst it means you will be paying two mortgage balances to the same mortgage lender, it can often be cheaper than the fees involved in a remortgage.

To get a further advance, you’ll need to pass the affordability check by your mortgage lender, to make sure that you can take out this additional mortgage. The maximum amount you can borrow will depend on the equity in your property, though you likely won’t be taking it all out.

Our Mortgage Advisors in Leeds will take a look at your case and help you to decide whether a remortgage to release equity or a further advance is a more suitable mortgage option for you.

Whether you are new to the industry or an experienced landlord with several buy to let properties to your name, you’re going to need more than just one mortgage.

Buy to let landlords that have an extensive property portfolio will be used in the process of getting more than one mortgage. Whereas if you are just starting, you will benefit from speaking with a mortgage expert.

The process of having multiple mortgages on buy to let properties are similar to any other mortgage route. You will still need to meet the criteria for the mortgage, put down a substantial deposit (typically at least 25% of the purchase price), and show that you can afford the monthly payments, even if you have no tenants living on the property.

For expert mortgage advice in Leeds, if you are looking for a Buy to Let Mortgage in Leeds, feel free to book yourself in for a free mortgage appointment today and we will see how we can help obtain a second mortgage.

Otherwise known as a let to buy mortgage, a variation of buy to let, this is an option that can allow homeowners to get a second mortgage on a newly purchased home, whilst renting out their current property, becoming landlords in the process.

With this type of process, you are planning on finding a tenant to move into your current property, so that you can move out. This is often a popular choice for landlords who would like to move into a bigger home, but keep a property in their portfolio.

You may be familiar with the term “accidental landlords”, people who perhaps never initially planned to become a landlord, with that plan changing as time has gone on.

Our expert Buy to Let Mortgage Advisors in Leeds also specialise in helping customers with let to buy mortgages, so book online today and we will see how we can help with your let to buy process.

If you know someone who is struggling to get on the property ladder, you may be able to take out a second mortgage in your name, allowing them to get their footing on the property ladder.

Another popular choice for some that don’t require a second mortgage is to gift a deposit. A gifted deposit can help you to get your family or friend onto the property ladder. Feel free to check out our helpful mortgage guides for more details.

In some circumstances, whilst you may have intended to take out a second mortgage, you may also find that you are listed on two mortgages.

As an open & honest Mortgage Broker in Leeds, the most common reason we see for people being listed on two mortgages is that they have become divorced or separated.

Unfortunately, it can be quite difficult to remove either your own or your ex-partner’s name from a mortgage, as not only do you both have to mutually agree on who gets removed, but you also have to prove the remaining party can afford to keep up payments by themselves.

If you happen to still be listed on a mortgage with an ex-partner, it is important to try and get your name removed as quick as you can. This ensures you are less likely to be affected by the financial links to your ex, as if they miss any payments, it could bring your credit score down.

Whilst this is the recommended route, if for some reason you are unable to get your name removed from a mortgage, there may still be mortgage options available to you. Some mortgage lenders will take your personal circumstances into account.

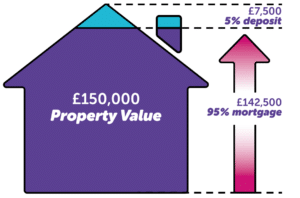

A 95% mortgage is when you borrow against 95% of a property’s price, covering the remaining 5% with your deposit. For example, if you looked at buying a property worth £150,000 with a 95% mortgage, you would put down £7,500 as your deposit and borrow the remaining £142,500.

With the March 2021 Budget, Boris Johnson declared a Mortgage Guarantee Scheme for Lenders, making 95% mortgages more promptly available from banks.

This is excellent news for both first-time buyers and home movers, as this will run until December 2022. Specific terms and conditions will apply. Your Mortgage Advisor in Leeds will be able to see if you qualify.

All our customers receive a free, no-obligation mortgage consultation from recommending the best mortgage deal tailored to your circumstances.

95% mortgages are generally available to both First-Time Buyers in Leeds & people looking at Moving Home in Leeds. Whilst the idea of saving for a 5% deposit sounds easy enough, you’ll still need to have a good credit score and prove that you can afford your monthly mortgage repayments to be granted a 95% mortgage.

A good credit score is a key to obtaining any mortgage, especially a 95% mortgage. Things like paying any existing credit commitments on time, ensuring your addresses are up-to-date and that you’re on the voters’ roll can all help build this up. For a more in-depth look at what you can do and why, please see our How to Improve Your Credit Score article.

Affordability is another key one. By providing details of your income and monthly outgoings (things like your bank statements will be necessary for this) and any pre-existing credit commitments, your lender will get a good idea of whether or not you can afford this type of mortgage.

These days, it’s trendy for family members to help each other get onto the property ladder, especially parents looking to further their children. This can be achieved by gifting the person looking to find their home and the property’s deposit. Known by some as the “Bank of Mum & Dad, Gifted Deposits work purely as a gift and not as a loan. The lender will need proof that this is the case before it can be used towards your mortgage.

When looking for a 95% mortgage, you want to make sure you’re on the right one. Each different mortgage type works in its own unique way, allowing you to find one that is best suited for your personal and financial situation.

You could find that you prefer Fixed Rate or Tracker Mortgages, where you either keep interest rates at a set amount for the term or have your interest rates follow the Bank of England base rates.

Alternatively, you might find that you’re better suited for an Interest-Only or a Repayment Mortgage. The former allows cheaper payments until you need to pay a lump sum at the end (more suitable for Buy-to-Lets), and the latter means you’ll be paying interest and capital combined per month.

As with anything involving such a significant financial outgoing, you need to be prepared and need to be wary. Things that might crop up include higher interest rates, remortgaging difficulties due to less equity, and negative equity.

The good news here is that all these can be avoided if you’re savvy enough with your initial process. The more deposit you put down, the less risk you are to the lender.

A larger deposit, of say 10-15%, would not only lower your interest rate significantly but would also put more equity in the property and reduce the risk of negative equity as you would be borrowing less against the property in question.

So, whilst the risks seem daunting at first, planning ahead and saving for a bigger deposit to access something like a 90% or even an 85% mortgage will be a definite lifeline and something you’ll be able to reap the rewards from.

A Mortgage Agreement in Principle is essentially a document to prove you have a mortgage in place. It is something we obtain for all our clients, and almost all lenders offer them. It demonstrates that you are creditworthy because of the Agreement certificate to be issued, you must pass the Lender’s credit score.

A Mortgage Agreement in Principle is not a guarantee that you will definitely get a mortgage as your full application will require further background checks (such as evidence and income) and a satisfactory valuation of the property itself. However, we think it’s a good idea to get one done at the earliest opportunity for the following reasons:

1. Negotiating Power

2. Avoid Disappointment

3. Knowing your Limits

When you are ready to offer a new home, most Estate Agents will undertake due diligence and ask you to produce evidence that you have funds available to complete the purchase. This will take the form of bank statements and an Agreement in Principle certificate that we can provide for you.

Once you have provided them with enough documentation the Estate Agent will naturally stop marketing the property and put a “Sold” or “Sale Agreed” boar outside the property to let other people know it’s off the market.

Suppose you already have a mortgage agreed upon before you make an offer. In that case, you are making yourself appear as an attractive proposition as this proves you are not making an offer on a “whim”, you’ve thought about how you’re going to fund the purchase and have done something about it. This might persuade a seller to accept an offer you put forward on their property underneath the asking price.

When it comes to buying a house some clients have always “put the cart before the horse” to say they go full steam ahead and make an offer on a property without first checking that they are actually in a secure financial position to proceed. This can lead to terrible disappointment if the mortgage application fails because, by that time, they have got their heart set on their new family home.

Furthermore, your mortgage getting refused isn’t always down to the offer you put in. It can sometimes be something else. For example, there may be a niggling issue on your credit report, perhaps a disputed mobile phone bill that can easily get rectified. Maybe you thought you were on the voter’s roll and you’re not – once again that can be sorted out given a few weeks.

Maybe you can’t get a mortgage at all, and if that’s the case, it’s better that you know now rather than mess people about, though we may be able to help if you contact us and we’ll be able to tell you what you need to do to improve your credit-worthiness for the future.

By now you know you’ve got a good credit rating because you’ve never got turned down for credit, you’ve registered on the voter’s roll and you’ve always made your credit card payments on time.

You could approach ten different Lenders these days and get ten different maximum mortgage amounts; they all calculate affordability in their own unique ways. If you’re self employed in Leeds: some Lender can take your net profit, others your salary and dividends. Some use your latest year, others an average over three years.

Knowing your borrowing limits is essential as then you know for sure what your price range is.

Our team of specialist mortgage advisors in Leeds may be able to advise you of the maximum mortgage available to you. Even more importantly together, we’ll work out how much you can afford to pay back each month.

If you find yourself wondering about the advantages of mortgage advice in Leeds or the reasons to consult a mortgage broker in Leeds, it’s worth exploring the numerous benefits you could receive.

Utilising the services of a mortgage broker in Leeds can provide you with several compelling advantages. We offer comprehensive advice across various areas and strive to secure a great mortgage deal that aligns with your specific mortgage scenario.

While our expertise covers a wide range of mortgage types, we specialize in assisting struggling first time buyers and individuals who have been declined by their bank. If you find yourself in a similar situation, it’s essential to reach out to us for specialist guidance from an experienced mortgage advisor in Leeds.

By working with a mortgage broker in Leeds, you benefit from our in-depth knowledge of the local market and our extensive network of lenders. We understand the unique challenges faced by home buyers and can provide tailored solutions to meet your specific needs.

When you’re ready to take the next step and approach your mortgage broker in Leeds, you can be confident that we have the expertise and resources to guide you through the process.

If you’re ready to embark on your mortgage journey and take the exciting step of getting onto the property ladder with a first time buyer mortgage in Leeds, our dedicated team of mortgage advisors in Leeds is here to support you every step of the way.

At Leedsmoneyman, we understand the importance of finding the perfect mortgage deal for first time buyers like yourself.

With access to a vast selection of first time buyer mortgage options, we will diligently search through thousands of deals to identify the one that best suits your needs and preferences.

Our 20 years of experience in the broker industry enable us to efficiently save your time and money, ensuring a seamless and stress-free process.

Our primary goal is to make your journey towards homeownership as smooth as possible. We are committed to providing you with expert guidance, personalised advice, and exceptional customer service throughout the entire mortgage process.

With our expertise and dedication, you can have confidence that you are in capable hands. Let our mortgage advisors in Leeds help you turn your homeownership dreams into a reality. Get in touch with us today and take the first step towards securing your ideal mortgage.

If you’re considering moving on and starting the process of moving home in Leeds, why not enlist the assistance of a dedicated mortgage advisor in Leeds?

At our mortgage broker in Leeds, we understand that there comes a time when people outgrow their current homes. Whether you’re seeking more living space, starting a family, or simply ready for a change, it’s natural to want to embark on a new chapter and find a new home.

By having a professional mortgage advisor in Leeds by your side, you can access the latest mortgage deals available in the market and alleviate the stress that often accompanies the process.

As an experienced mortgage broker in Leeds, our priority is to save your valuable time and money, even in situations where it may seem challenging to do so.

We have the expertise and resources to explore a wide range of mortgage options, ensuring that you have access to the most suitable deals for your specific needs. By entrusting us with your moving home journey, we aim to streamline the process and make it as efficient and cost-effective as possible.

Let us take the stress out of your moving home experience. Reach out to us today and discover how we can help you on the next chapter in your home owning journey.

If the end of your current mortgage deal is fast approaching, it’s a great opportunity to consider remortgaging and potentially secure a the best deal available to you. Here’s where our expert remortgage advisors in Leeds step in to help you every step of the way.

While it may seem convenient to switch over online, we strongly believe that reaching out to our team will offer you a more comprehensive and tailored approach. When you choose our services, we go the extra mile by comparing external deals from a wide range of lenders on your behalf.

With access to an extensive panel of lenders, we have the ability to search through thousands of options, ensuring that we find the most suitable and advantageous deals for you.

Our remortgage advisors in Leeds have the expertise and knowledge to guide you through the entire process. We take the time to understand your unique circumstances, financial goals, and preferences.

By doing so, we can provide personalised recommendations and advice that aligns with your specific needs. Our mission is to make the remortgaging journey as seamless and stress-free as possible for you.

We handle the complexities and intricacies, while keeping you well-informed and involved in the decision-making process. You can trust us to navigate the extensive market, perform thorough comparisons, and present you with viable options that suit your requirements.

Get in touch with our reliable remortgage advisors in Leeds. Let us use our expertise, access to multiple lenders, and commitment to exceptional customer service to help you secure the perfect remortgage deal. Contact us today to start your remortgage in Leeds.

Are you currently a landlord in Leeds or thinking about diving into the world of buy to let mortgages in Leeds? Well, it might be time for you to consider getting some mortgage advice in Leeds.

We’ve been working with landlords like you in the Leeds area for more than 20 years, and we’d love for you to be our next success story! So why not reach out to us for a free consultation on Buy to Let mortgages?

We understand that being a landlord comes with its own set of challenges, especially when it comes to navigating the mortgage market. That’s where our expertise and experience kick in. Our team knows the ins and outs of the local rental market, and we’re here to guide you through the process.

When you choose our mortgage advice in Leeds, you gain access to a wide range of services tailored to your needs. We’ll help you understand your financial situation, explore different mortgage options, and develop a customised plan that aligns with your investment goals.

What sets us apart is our commitment to exceptional customer service. We genuinely care about your success, and that’s why we offer a free buy to let mortgage consultation.

It’s your chance to have a chat with our experienced advisors, ask any questions you have, and get valuable insights based on your unique circumstances.

So, whether you’re a seasoned landlord looking to grow your portfolio or a first-time investor ready to take the leap into the buy to let market, we’re here to support you. Contact us today, and let’s schedule your free consultation. Together, we’ll help you achieve your property investment dreams in Leeds.

We understand that obtaining a mortgage can pose challenges for individuals who are self employed. That’s precisely why we are here to extend our support and guidance.

With our extensive expertise as a trusted mortgage broker in Leeds, we have successfully helped countless self employed clients in realising their mortgage aspirations.

Even when confronted with obstacles along the journey, our commitment remains unwavering as we strive to overcome any hurdles and secure a favourable mortgage solution that aligns perfectly with your unique personal and financial situation.

Rest assured, we are dedicated to ensuring that you receive the best possible deal available for a self employed mortgage in Leeds.

Navigating a challenging mortgage situation on your own can be overwhelming and stressful. With a dedicated specialist mortgage advisor in Leeds at your side, you can rest assured that the burden will be lifted off your shoulders.

With our extensive experience of over 20 years in the industry, we are well-equipped to address your mortgage concerns swiftly and efficiently.

At Leedsmoneyman, we thrive on handling new and complex mortgage scenarios regularly. Embracing every opportunity as a chance to demonstrate our expertise, we eagerly embrace challenges with enthusiasm.

When dealing with mortgages in Leeds, our passion lies in helping clients like you, ensuring that we tailor solutions that match your unique circumstances.

With us by your side, you can expect dedicated attention, personalised assistance, and the expertise required to find the best possible resolution for your specific needs.

Don’t let your mortgage worries linger – contact us today, and let’s work together to secure your financial future with confidence and ease.

At the start of the Coronavirus pandemic, the Government promised that all borrowers would be allowed a three-month mortgage payment holiday if they needed it. Most lenders followed the Government’s guidelines and did their best to help their borrowers during these hard few months.

We have thought carefully about the possibilities of what could happen to your Mortgage over the next few months. We are working very closely with all of our lenders to ensure that if anything changes, we can inform you right away and recommend the best option for you to take so that you still feel secure and happy with your Mortgage.

We feel that it is best to summarise what mortgage payment holidays are, what lenders are doing, and who can provide you with help and guidance through these next few months.

Mortgage payment holidays are an agreement entered into with your bank, building society or mortgage lender to defer your monthly mortgage payments for a set period. In this case, 3-months.

It does not mean you never have to pay the amount back, but the interest you defer gets added ago onto the loan amount, while your capital balance will not decrease. In other words, your mortgage amount will increase slightly, and you will continue to attract interest on the whole amount.

When you are ready to continue the payments, this could mean that either your monthly payments recalculated at a slightly higher level or your mortgage term gets increased somewhat. Most lenders will probably prefer not to extend your mortgage term as this could take you past their standard retirement ages, but the detail on this will follow in due course.

Dependent on your mortgage deal, you may be able to pay off a lump sum later in the year to bring your Mortgage back to where it would have been.

Mortgage Payment Holidays are available both for those with residential or Buy-to-let mortgages in Leeds, which means landlords also have assistance if rental payments are affected.

• Mortgage lenders will offer an automatic 3-month mortgage payment holiday for customers impacted, directly or indirectly, by COVID-19.

• The mortgage payment holiday will apply to customers who are up to date on their payments, not in arrears, and wanting to self-certify that COVID-19 impacts them.

• This means that lenders will not complete an income and expenditure assessment or evaluation of alternate payment options as ordinarily required under MCOB.

• This proposal will allow lenders to be more responsive to customer needs and offer forbearance in a simple way to customers in an environment where COVID-19 also impacts the operation of collections teams made.

• Customers will be made aware that interest will accrue in the holiday period, and they will need to make up deferred payments in the future.

• Customers who wish to undertake a full assessment of their ability to pay or financial difficulty may still do so.

We are reviewing your Mortgage Payment Holiday. We would recommend speaking to your Mortgage Advisor in Leeds. in the first instance rather than instantly looking to take a mortgage payment holiday if there isn’t a pressing need to do so as Lenders will be prioritizing most cases first.

By approaching a Mortgage Broker in Leeds, we will be able to talk through your circumstances and look at all options available for your situation.

• The customer would contact the lender and inform them that they are affected by COVID-19.

• The lender would accept these details from the customer and offer an automatic 3-month mortgage payment holiday.

• No evidence will be sought from the customer.

• The lender makes the customer aware that interest will accrue and will be contacted at the end of the three months to complete an assessment of the customer’s circumstances.

• At the end of three months, an arrangement to pay will be agreed with the customer according to their circumstances to recover any shortfall. (While ensuring that the Mortgage remains affordable and sustainable).

• The lender notifies the customer that if they wished to complete a full assessment now, there might be other forbearance options more suitable to the customer.

In some cases, a mortgage payment holiday can hurt your credit score, but most lenders have now said that for cases linked to the virus, they will ensure that this is not the case.

You must ask this question to your lender directly and record the response, including the date and the name of the person you are speaking to avoid confusion later. Different lenders are doing other things.

At first, everything seemed like it would remain the same, and you would still be able to make changes to your mortgages as usual. Additionally, this has changed in the last couple of days, and lenders have been asking borrowers to avoid making changes whilst you are within a mortgage holiday period. So, at the moment, they are not allowing mortgages and product transfers.

Borrowers nearing the end of their existing product may get forced to move on to the higher lenders variable rate. Meaning that borrowers who act too early could find themselves on a mortgage payment holiday that accrues interest on a costly variable rate.

We would highly recommend speaking to your Mortgage Advisor in Leeds, and they will determine the best course of action based on your personal and financial situation. If possible, arranging your mortgage transfer first then asking for the holiday would seem to be the most sensible way forward.

At the moment, no Lenders have withdrawn mortgage offers; in fact, some are extending offers past the standard six-month expiration date.

It would help if you did not pull out of your purchase unless, for example, you are worried about losing your job as a result of Coronavirus. We are advising everyone to proceed as usual for now and “wait and see” – you are not committed to completing your purchase until contracts get exchanged.

In some cases, lenders can offer you a temporary switch to interest-only to reduce your monthly payments but not to add any further to the loan amount by still servicing the interest payments each month.

It may not be necessary to convert all your Mortgage to interest only, and it may be that putting part of the Mortgage on this basis could give you the breathing space you need.

People with savings may find that remortgaging onto an offset basis could give them a helping boost they were looking for, and they will be cutting down on their monthly payments whilst keeping hold of their savings.

For example, someone with a £400,000 loan and £100,000 in savings would only pay interest on £300,000. Additionally, this will massively reduce their monthly mortgage payments.

For others, a straight remortgage to another lender, calculating the cost of any early repayment charges, may well be enough to ease the burden or simply extending the term of your Mortgage.

If you still have any other questions on mortgage payment holidays or want general Mortgage Advice in Leeds, give us a call today. We want to help you and your mortgage journey through these tough few months ahead. Speak to an experienced Mortgage Advisor in Leeds today.

Speak to an Advisor – It’s Free!

7 Days a Week, 8am – 10pm