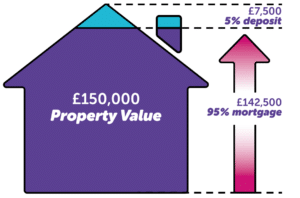

A 95% mortgage is when you borrow against 95% of a property’s price, covering the remaining 5% with your deposit. For example, if you looked at buying a property worth £150,000 with a 95% mortgage, you would put down £7,500 as your deposit and borrow the remaining £142,500.

95% Mortgage Advice in Leeds

With the March 2021 Budget, Boris Johnson declared a Mortgage Guarantee Scheme for Lenders, making 95% mortgages more promptly available from banks.

This is excellent news for both first-time buyers and home movers, as this will run until December 2022. Specific terms and conditions will apply. Your Mortgage Advisor in Leeds will be able to see if you qualify.

All our customers receive a free, no-obligation mortgage consultation from recommending the best mortgage deal tailored to your circumstances.

Can I get a 95% mortgage?

95% mortgages are generally available to both First-Time Buyers in Leeds & people looking at Moving Home in Leeds. Whilst the idea of saving for a 5% deposit sounds easy enough, you’ll still need to have a good credit score and prove that you can afford your monthly mortgage repayments to be granted a 95% mortgage.

Improving your credit score

A good credit score is a key to obtaining any mortgage, especially a 95% mortgage. Things like paying any existing credit commitments on time, ensuring your addresses are up-to-date and that you’re on the voters’ roll can all help build this up. For a more in-depth look at what you can do and why, please see our How to Improve Your Credit Score article.

Affordability

Affordability is another key one. By providing details of your income and monthly outgoings (things like your bank statements will be necessary for this) and any pre-existing credit commitments, your lender will get a good idea of whether or not you can afford this type of mortgage.

Can my family help me get a 95% mortgage?

These days, it’s trendy for family members to help each other get onto the property ladder, especially parents looking to further their children. This can be achieved by gifting the person looking to find their home and the property’s deposit. Known by some as the “Bank of Mum & Dad, Gifted Deposits work purely as a gift and not as a loan. The lender will need proof that this is the case before it can be used towards your mortgage.

How do I choose the right 95% mortgage?

When looking for a 95% mortgage, you want to make sure you’re on the right one. Each different mortgage type works in its own unique way, allowing you to find one that is best suited for your personal and financial situation.

You could find that you prefer Fixed Rate or Tracker Mortgages, where you either keep interest rates at a set amount for the term or have your interest rates follow the Bank of England base rates.

Alternatively, you might find that you’re better suited for an Interest-Only or a Repayment Mortgage. The former allows cheaper payments until you need to pay a lump sum at the end (more suitable for Buy-to-Lets), and the latter means you’ll be paying interest and capital combined per month.

How can a more significant deposit help with my mortgage?

As with anything involving such a significant financial outgoing, you need to be prepared and need to be wary. Things that might crop up include higher interest rates, remortgaging difficulties due to less equity, and negative equity.

The good news here is that all these can be avoided if you’re savvy enough with your initial process. The more deposit you put down, the less risk you are to the lender.

A larger deposit, of say 10-15%, would not only lower your interest rate significantly but would also put more equity in the property and reduce the risk of negative equity as you would be borrowing less against the property in question.

So, whilst the risks seem daunting at first, planning ahead and saving for a bigger deposit to access something like a 90% or even an 85% mortgage will be a definite lifeline and something you’ll be able to reap the rewards from.

Date Last Edited: December 6, 2023